Tax-Deductible Donations

YOU CAN HELPBy making a tax-deductible donation you will be helping our mission of providing support to families, promoting awareness, and advancing the science of scoliosis detection, treatment and prevention. Thank you for your support!

MEMORIAL DONATIONS

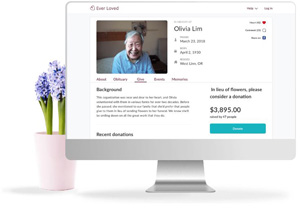

Ever Loved offers free memorial websites where you can add photos, memories and more. Charitable donations can be made directly on your memorial page. Start a memorial site here